Chatbots are robots which are built using Artificial Intelligence that simulates human conversion. In recent years, the chatbots are high in demand in worldwide market since it reduces the cost of hiring customer support executives making the entire customer support process automated. So Chatbots are also called as Chatterbots.

The latest 2017 survey indicates 2017 has been the largest year of the breakout for Chatbots as every sector has seen the tremendous increase in usage of Chatbots. During early 2000, when banking through the internet was just emerging which increases the smartphone saturation increased the number of customers using mobile banking applications. Once mobile banking started growing need for chatter bots to provide support increased. The Recent survey conducted by Garner indicates about 85% of customers will be able to interact with a brand without the need of real human beings due to advancement in Artificial Intelligence.

ChatBot Development is gaining large recognition in the entire world. When a survey was conducted among 5,000 people 38% of customers felt chatbots experience as positive, 51% customers had neutral experience, only 11% customer has the negative experience of chatbots.

Chatbots in Banking Sector

Chatbots in banking sector provide digital solutions under affordable budget also easy to maintain. For beginners, using chatbots requires no coding knowledge other than understanding the basic standalone feature of banking applications. The recent growth in messaging platforms will save banks huge cost of building their own channels as well as save the data storage capacity using cloud-based server and systems.

Cleo, Stripe, And Wealthfront are companies generally developing chatbots which improves conditions for traditional banks to handle money. However, these companies are struggling to develop chatbots meeting the needs in key product areas of banking sector such as loans due to very less restrictive regulations which force their customers to invest more capital and compliance.

DBS makes use of Kasisto’s Kai, which generally built on the technology of MyKai, which allows banking customers to transact, transfer and pay bills. Also, customers get to know all the details of personal finances through world popular messaging platforms like Facebook Messenger, WhatsApp, and WeChat.

In the year 2016, Swedbank launched its first mobile application named “Nuance’s NINA” in their website, this is chatbot which helps the customer solve their inquiries very quickly by tracking all the information relevant to customer inquiries using intuitive analysis.

Chatbots in Financial Sector

Generally, finance industry hugely depends on information processing, which makes it an ideal industry for automation using chatbots which bring in the reduction in salary expenditure, as per the latest report from PwC. Nearly ⅔ of the US financial sector service provider feel they are limited in resources like operations, regulations, budgets to make an investment in innovative development.

Financial Technology service providers like Plum, Cleo, and Digit are developing chatbots which help in saving small amount daily for their customers which encourages micro saving scheme. These companies also focus on developing core products, unlike legacy banks which supplement the core product.

All these fintech companies are developing and improving ways to provide more services to customers other than automated savings.There focus is on developing chatbots which can provide wealth management for huge customers at once, underwrites the insurance and loans, provides data analytics and advanced analytics services to detect the fraudulent behavior of customers all through by virtual means.

The Bank of America uses “ERICA” chatbot to give their customers real-time updates with all the key features about their finances through a channel customers prefer. ERICA is enabled with predictive analysis and cognitive messaging which helps customers to check the current balance, make payments and pay down the remaining debts.

Pros of Using Chatbots:

- 24/7 customer service tool as they can operate without any human interaction once they are set up.

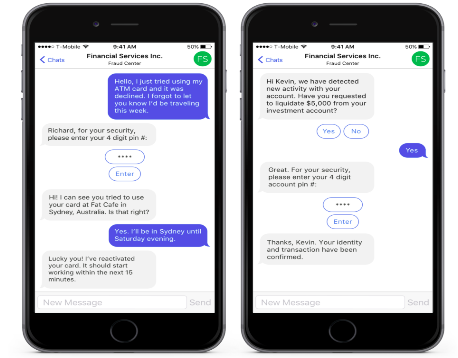

- Chatbots will help in automation of detecting fraud collect all the relevant information of their users or customers.

- Chatbots can help in pushing test user engagement and all the relevant content to the end users.

- Chatbots will increase the revenue and personal strategic growth of the company with automated data gathering making several improvements.

- Chatbot will enhance the brand value in the market with a similar message, one tone, and voice for every customer.

- Chatbots will be very useful during peak business hours and extra staffing needed on holidays.

- Chatbots function smoothly during both situation when the volume is low and during peak times which means that the response time will be consistent throughout the process leading to a great customer support experience.

Cons Of Using Chatbots:

- Chat Bots will not be able to give a right answer to your questions unless the user asks the exact phrase in which they are set up to interpret.

- Chat Bots are not unable to answer multiple questions asked at once.

- Most cases chatbots don’t interact question correctly as they are still not contextually aware.

- Chatbots cannot handle real-life scenarios.

- Chatbots cannot handle personal questions.

Conclusion

Chatbot is the technology which will continue to improve over time,due to increased demand of robotics in banking and financial services. Chatbot design and architecture gradually will develop to interact with customer as AI development becomes more interactive. Several chatbot applications will come into market across various sector as time progresses and AI Becomes need for these sectors.

Agileblaze provides innovative solutions for banking, retail and health sectors using chatbots. To know more, feel free to reach out to use at innovation@agileblaze.com